The UK’s largest constructing society is dropping its most cost-effective mortgage charge to an eight-month low and considerably underneath the Bank of England’s base rate of interest.

From Wednesday, Nationwide will provide new remortgaging prospects a 3.84% charge on a five-year fastened deal.

Existing mortgage holders can get the low charge on extra borrowing and switcher offers, additionally on five-year affords.

New members and first-time patrons can get a barely increased five-year fastened charge of three.85%.

Money newest: Woolworths might return to UK excessive road

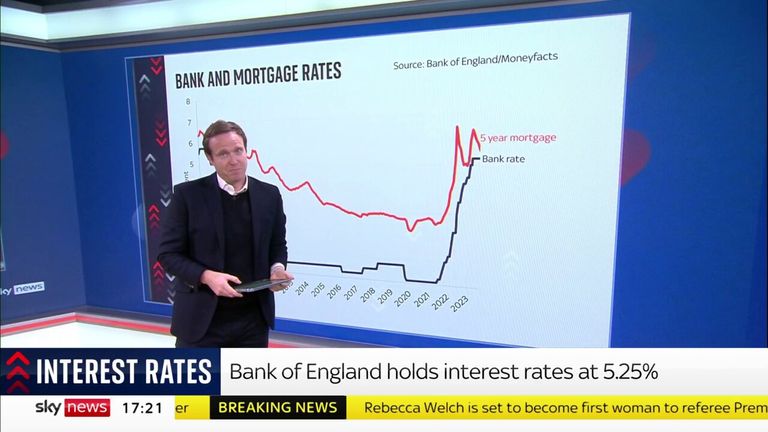

As nicely as being beneath the Bank of England’s 5.25% base charge, such a proposal can also be beneath the present common five-year mortgage charge, which stood at 5.2% on Tuesday, in accordance with monetary data firm Moneyfacts.

Henry Jordan, director of dwelling at Nationwide Building Society, stated: “These latest changes mean we are now offering sub-4% rates for the first time in eight months.”

But one other lender, Santander, is rising charges on a few of its mortgage merchandise.

Plenty of commonplace residential fastened charges will rise by as much as 0.2% for buy and remortgage shoppers, it stated.

A Santander spokesman stated: “Santander continually reviews its rates based on a number of factors, such as wider market conditions including swap rates.

“We provide a spread of aggressive mortgage offers with five-year offers ranging from 3.99% and two-year offers ranging from 4.25%.”

Mortgage charges had in the summertime risen to above 6% for typical fastened offers however have dropped within the final 4 months because the falling tempo of inflation led markets to readjust their expectations of when the Bank would scale back the bottom charge.

Both the bottom charge and market expectations have an effect on the mortgage merchandise shoppers are provided.

The Bank of England hiked rates of interest 14 consecutive occasions in an effort to tame the double digit tempo of value rises seen within the wake of the power disaster when Russia invaded Ukraine.

Banks and constructing societies can differ charges based mostly on quite a lot of components together with the quantity of uptake for a given provide and whether or not it is a time of 12 months that mortgage holders could also be trying to change or would-be new patrons could also be on the hunt.

Content Source: information.sky.com