Jeremy Hunt has advised Sky News he’s snug with Britain being plunged into recession if that is what it takes to deliver down inflation.

The chancellor mentioned that he would totally assist the Bank of England elevating rates of interest larger, probably in the direction of 5.5%, because it battled higher-than-expected costs.

Asked by Sky News whether or not he was “comfortable with the Bank of England doing whatever it takes to bring down inflation, even if that potentially would precipitate a recession”, he mentioned: “Yes, because in the end, inflation is a source of instability.

“And if we wish to have prosperity, to develop the financial system, to cut back the chance of recession, we’ve to assist the Bank of England within the troublesome selections that they take.

“I have to do something else, which is to make sure the decisions that I take as chancellor, very difficult decisions, to balance the books so that the markets, the world can see that Britain is a country that pays its way – all these things mean that monetary policy at the Bank of England (and) fiscal policy by the chancellor are aligned.”

The feedback got here after market expectations for the eventual peak of UK rates of interest leapt dramatically, following higher-than-expected CPI inflation knowledge this week.

While the anticipated peak for UK charges was a little bit above 4.75% final week, it lurched larger, to five.5%, following Wednesday’s statistics. Save for the gyrations after the mini-budget final autumn, it was the largest shift in rate of interest expectations since 2008.

Prime Minister Rishi Sunak pledged in January that he would halve inflation this yr, which in observe means bringing it down to simply above 5% by the top of 2023. The Bank of England’s forecasts earlier this week prompt he would narrowly succeed.

Read extra:

Grocery inflation eases for second consecutive month

Government borrowing sharply larger than anticipated

However, for the reason that newest inflation knowledge is considerably larger than the Bank’s forecast trajectory, the pledge could also be missed.

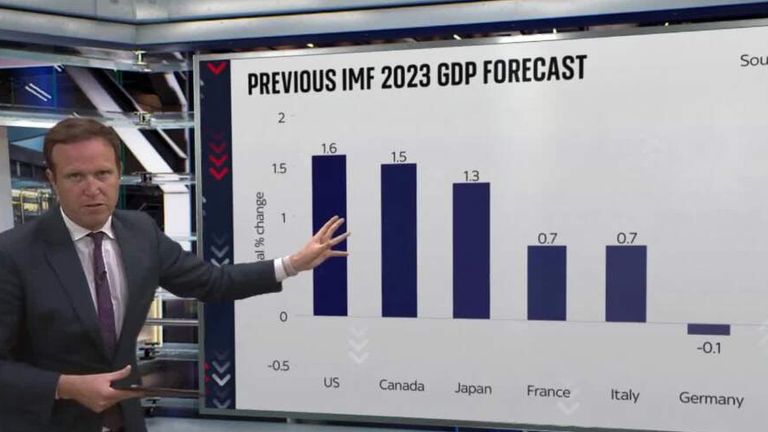

But the prime minister additionally pledged to develop the financial system. And whereas the International Monetary Fund mentioned this week that the UK would keep away from recession, economists consider it is now believable, given these larger rate of interest expectations, that Britain as a substitute sees gross home product contract for 2 quarters – the technical definition of a recession.

Mr Hunt added: “When the prime minister announced that it was his objective to halve inflation in January, there were some people who derided that, they said: ‘well it’s automatic, inflation is going to come down anyhow’.

“There’s nothing computerized about bringing down inflation, it’s a massive activity, however we should ship it and we’ll.

“It is not a trade-off between tackling inflation and recession. In the end, the only path to sustainable growth is to bring down inflation.”

Content Source: information.sky.com