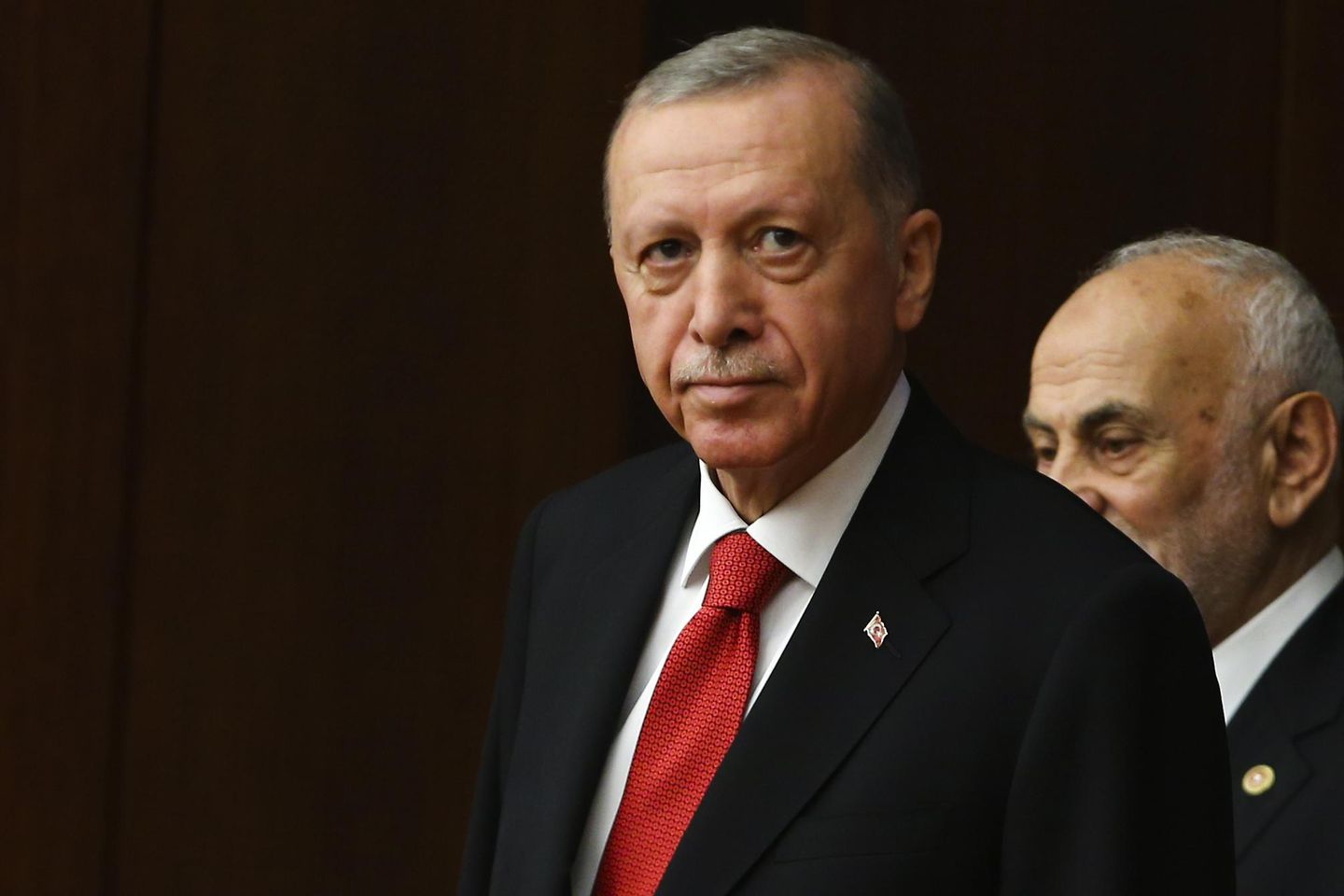

ANKARA, Turkey — Turkish President Recep Tayyip Erdogan appointed a former U.S.-based financial institution government to go the central financial institution Friday, sending the strongest sign but that the newly reelected chief may pivot from his uncommon financial insurance policies that many blame for worsening a cost-of-living disaster.

Hafize Gaye Erkan, 41, is Princeton-educated and can turn out to be the primary lady to guide the Turkish central financial institution. She briefly served in 2021 as co-chief government of First Republic Bank, which final month grew to become the second-largest U.S. financial institution to fail as its rich shoppers pulled their cash throughout wider turmoil within the sector.

Her nomination follows final week’s appointment of Mehmet Simsek, an internationally revered former banker, as treasury and finance minister. He was a former finance and deputy prime minister beneath Erdogan and returned after a five-year break from politics.

The selections for 2 key monetary roles have raised hopes that Erdogan, reelected final month to a 3rd time period, will transfer away from his insistence that decrease rates of interest will battle Turkey’s staggering inflation. The charge peaked at 85% in October, and individuals are struggling to afford meals, housing and different requirements.

Critics blame the cost-of-living disaster on Erdogan’s unorthodox strategy, which runs opposite to standard financial pondering – that elevating charges will fight inflation. Central banks from the U.S. Federal Reserve, European Central Bank and others worldwide are mountaineering borrowing prices to deliver down spikes in client costs.

Erkan’s appointment “is an important step toward more credible economic policies and provides encouragement that President Erdogan will loosen his grip on the central bank,” mentioned Liam Peach, senior rising markets economist at Capital Economics.

“Recent policy appointments will now need to turn into policy action for investors to be confident that this shift towards orthodoxy is the real deal,” he mentioned.

The subsequent steps are important because the economic system struggles with a crashing forex and inflation at a still-high 39.5%. The central financial institution will meet later this month to resolve on rates of interest – a key indicator of the course Turkey’s economic system will take.

In latest years, Erdogan has fired three central financial institution governors for failing to fall consistent with his rate-cutting insurance policies.

“Erkan needs to be given the freedom to raise interest rates sharply,” Peach mentioned. “A large interest rate hike from 8.5% to 20% or so would send a very strong signal that this is a credible policy shift.”

She additionally should present that it’s essential to maintain charges excessive to ease inflation. While larger borrowing prices are designed to battle inflation, they will gradual financial development as loans turn out to be dearer.

It might be one other ache level for households and companies which have seen meals and vitality prices soar following Russia’s invasion of Ukraine and their forex hit document lows in opposition to the U.S. greenback.

Erkan was a managing director on the Goldman Sachs funding banking firm and labored at San Francisco-based First Republic Bank, holding the submit of co-CEO for six months in 2021. JPMorgan Chase took over the failed financial institution after U.S. regulators seized it in May.

She replaces Sahap Kavcioglu who oversaw a collection of charge cuts since 2021. Kavcioglu now turns into head of Turkey’s banking watchdog, referred to as BBDK.

“Appointing Kavcioglu – a cheerleader of Erdogan’s ‘new economic model’ – as head of the banking regulator is a powerful reminder that Erdonomics can bite back anytime,” mentioned Wolfango Piccoli, co-president of the London-based danger consultancy Teneo.

Erkan should rebuild the central financial institution “after years of mismanagement, purges, and demotions,” Piccoli wrote in a notice.

“Like most other key institutions, the (central bank) has lost its independence and has been hollowed out by Erdogan’s drive to centralize power, with key jobs given to loyalists and cronies,” he mentioned.

Content Source: www.washingtontimes.com