People in authorities inform me they suppose the governor of the Bank of England is failing in his job, however can’t do something about it.

That Andrew Bailey is underneath stress is just not unsure.

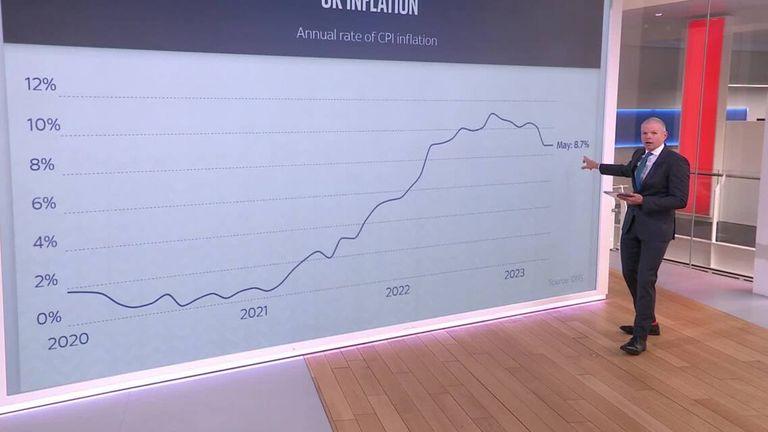

Today’s 8.7% year-on-year inflation rise is a painfully good distance from the governor’s 2% goal – which means tomorrow, the Bank will elevate rates of interest once more.

Core inflation is rising within the UK, however dropping within the US and Germany, making it tougher to take care of that is all a world downside.

There is little doubt some Tories are in search of a scapegoat within the face of a looming political nightmare.

Yet it is usually true the cost sheet that many cite in opposition to Bailey is lengthy: the Bank beginning rate of interest rises too late, not elevating them quick sufficient, doing an excessive amount of pointless quantitative easing throughout the pandemic and for too lengthy, and for not being clear sufficient in his communications.

The anger felt by some Tories in direction of the governor is palpable.

Many felt justified on the flip of the 12 months counting on Bank’s reassurances that inflation would tumble by the tip of this 12 months.

But, because the chair of the Treasury Select Committee Harriet Baldwin identified within the Commons this week, this hasn’t occurred as predicted.

However, Mr Bailey appears untouchable – and never simply due to the nominal independence of the Bank of England.

In actuality, that is yet one more of the uncomfortable legacies of the Liz Truss period, when the federal government and Bank of England have been at odds, pulling in several instructions, which means the worldwide markets took fright.

As a direct consequence, Rishi Sunak’s authorities has determined there can’t be any public query about the way forward for the governor for concern of spooking markets once more at a time when debt prices are at latest highs.

With that in thoughts, some in authorities have been checking just lately when Mr Bailey’s time period expires, solely to find he’s staying in place till 2028.

The unusually prolonged time period is one other legacy of Tory reforms.

After Gordon Brown almost refused a second four-year time period for Mervin King as governor, George Osborne prolonged the interval to eight years when he appointed Mark Carney.

Now his successors are trapped with a person that some are not looking for dealing with the most important problem dealing with authorities.

For throughout Whitehall, they’re acutely aware the nightmare inflation is inflicting – however that the primary lever to take care of it, elevating rates of interest, is just not working.

Interest charge rises are supposed to improve prices, decreasing households capability to spend and therefore, cool the economic system.

Yet few are on variable charge mortgages and really feel the ache instantly, and plenty of don’t have any mortgage in any respect.

For these remortgaging this 12 months, it is usually a catastrophe, and the overlap right here with Tory voters is massively politically problematic.

But the larger downside for presidency is that not sufficient persons are feeling the squeeze, so curbing spending and thereby cooling the economic system. And if the economic system retains overheating, inflation rises after which rates of interest will hold going up.

The conventional levers have failed.

Meanwhile, the cry from Tory backbenchers is for extra assist for owners, maybe mortgage tax aid or different schemes – and even blanket tax cuts.

In the short-term, nonetheless, ministers concern it will stoke the economic system and result in greater inflation, making the issue worse.

The economic system appears in a vicious spiral, and plenty of Tories need somebody responsible.

Yet, the answer to deliver down inflation includes intentionally inflicting financial ache on households within the run as much as an election.

Working out merely the place to level the finger will not be sufficient.

Content Source: information.sky.com