Labour has unveiled a five-point plan to deal with the mortgage disaster – however Rishi Sunak is insisting that “beating inflation has to be the priority”.

The Opposition and the prime minister have been talking forward of the Bank of England making ready to hike pursuits charge but once more after inflation within the UK defied expectations and didn’t fall.

It has led to warnings of a “ticking time bomb” for owners whose mortgage funds are prone to soar by tons of of kilos per 30 days, sparking fears of an increase in house repossessions.

Labour is looking on the federal government to right away undertake 5 measures, which embody requiring banks to permit debtors to modify to interest-only mortgage funds and lengthen the time period of their mortgage interval.

Labour’s plan additionally contains:

• Requiring lenders to reverse any assist measures when the borrower requests

• Requiring lenders to attend a minimal of six months earlier than initiating repossession proceedings

• Instructing the FCA (Financial Conduct Authority) to urgently concern shopper steerage to forestall the adjustments from impacting credit score scores

Inflation newest updates: One determine inside knowledge is ‘deeply worrying’

Labour mentioned the mortgage disaster is worse within the UK than neighbouring superior economies reminiscent of France and Ireland, with the hole in charges costing a typical family in Britain £1,000 extra in repayments.

Shadow chancellor Rachel Reeves mentioned thousands and thousands of individuals “face a mortgage catastrophe made in Downing Street”.

She added: “Our five-point plan to ease the Tory mortgage penalty offers practical help now, while our commitment to fiscal responsibility and growth will secure our economy for the future.

“Instead of squabbling over peerages and events and ruling out any motion on mortgages, the Tories must be taking duty and appearing now.”

But the prime minister appears to be sticking to his guns with his insistence that any intervention could make inflation worse in the long run.

In a speech being delivered by Mr Sunak on Thursday, he will acknowledge the “regarding” time for families and businesses.

But he will stress that failing to get a grip on inflation now will mean the damage to the economy will be worse and longer lasting.

He will say: “I really feel a deep ethical duty to ensure the cash you earn holds its worth.

“That’s why our number one priority is to halve inflation this year and get back to the target of 2%.

“And I’m fully assured that if we maintain our nerve, we are able to accomplish that.”

Pressure grows on Sunak

Downing Street is coming below rising strain to intervene because the UK’s mortgage crunch deepens.

The Bank of England is anticipated to lift rates of interest on Thursday for the thirteenth time in a row – having already hiked it from 0.1% in December 2021 to 4.5%, the place it presently stands.

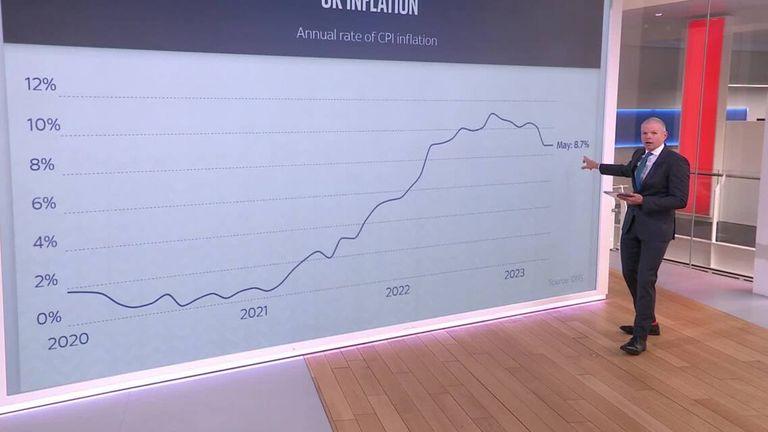

It comes after disappointing inflation figures confirmed worth rises haven’t eased, with the speed remaining at 8.7%.

This places the federal government’s pledge to halve inflation by the top of the yr in jeopardy.

And excessive rates of interest imply dearer borrowing, sending mortgages greater.

The Institute for Fiscal Studies warned the transfer may see an estimated 1.4 million mortgage holders – half of them aged below 40 – lose greater than 20% of their disposable earnings.

The impartial assume tank mentioned the typical mortgage-holding family faces paying almost £280 extra every month in contrast with this time final yr – with 30 to 39-year-olds paying almost £360 extra.

It adopted warnings from economists on the Resolution Foundation that annual mortgage repayments are set to rise by £2,900 for the typical family remortgaging subsequent yr.

Meanwhile the standard charge for a two-year fastened deal rose to six% on Monday – a excessive not seen since 2008 except for after Liz Truss’s botched mini-budget.

Ms Reeves will set out extra element of Labour’s plan when she visits Boris Johnson’s vacated Uxbridge and South Ruislip seat on Thursday.

Read More:

No lower in inflation because it stays at 8.7%

Jeremy Hunt guidelines out mortgage assist and capping meals costs

‘Tidal wave of repossessions’

Seperately, Liberal Democrat chief Sir Ed Davey urged ministers to behave now to forestall a “tidal wave” of house repossessions – with an emergency mortgage safety fund paid for by a reversal of tax cuts for large banks.

Analysis by the occasion reveals 1,250 owners have needed to hand again the keys to their properties after falling behind on their mortgage repayments since final yr’s ill-fated mini-budget, which plunged the market into turmoil.

Lasting for a yr, the safety fund would supply focused assist within the type of grants of as much as £300 a month to owners on the bottom incomes and people affected by the sharpest rises in charges.

There are additionally calls from some Conservatives to supply main monetary assist to defuse a “mortgage bomb” hitting core voters.

And the Green Party pressured the necessity for controls on rents to forestall landlords passing on hikes on buy-to-let mortgages to tenants.

Chancellor Jeremy Hunt will meet lenders on Friday to ask what assist they can provide to struggling debtors and see what flexibilities they will supply to these in arrears.

But Downing Street made clear the chancellor is not going to be forcing lenders to take motion.

The prime minister’s official spokesman mentioned: “We’re not seeking to intervene in commercial decisions for banks offering mortgages.

“We need banks to offer the very best merchandise to customers, that is in everybody’s curiosity. And so we will likely be trying to dig into what extra they are often doing on this house.”

Content Source: information.sky.com