An rate of interest rise by the Bank of England at noon is a nailed-on certainty – although opinions are break up on the extent of further ache that may very well be imposed as efforts to curb the nation’s inflation drawback stumble.

At the beginning of this week, policymakers have been broadly tipped to lift the bottom fee by 1 / 4 of a proportion level to 4.75% – a report thirteenth consecutive improve – sustaining a slower path for hikes since March.

But the newest inflation figures, printed yesterday, prompted monetary market contributors to anticipate a larger, nearly even, likelihood of a half proportion level hike to five%.

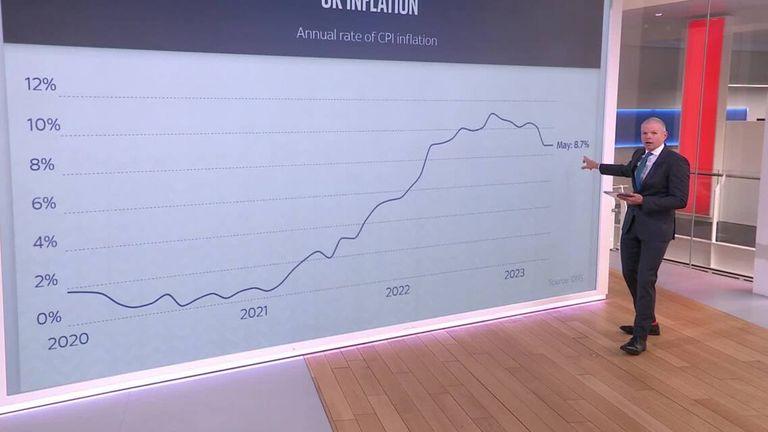

While there have been already considerations concerning the cussed tempo of value rises, the inflation knowledge got here as a shock.

It confirmed value progress was turning into extra engrained within the economic system whereas the principle client costs index (CPI) additionally didn’t budge decrease as most consultants had predicted.

The Bank had additionally beforehand expressed considerations concerning the tempo of wage rises which, it argues, contributes to demand and additional inflation forward.

Inflation is proving tougher to chill than had been anticipated, and Chancellor Jeremy Hunt informed Sky News final month he would even be snug with a recession if it introduced inflation to heel.

The solely device the Bank has to do this, fee rises, will imply extra ache for debtors no matter at present’s fee resolution brings.

Growing rate of interest expectations over current weeks have pressured up funding prices for lenders, with knowledge from Moneyfacts this week displaying common charges for two-year mounted mortgage offers rising above 6%.

They have continued to rise every day this week having stood simply above 2.5% in March final 12 months.

With the monetary markets now seeing the Bank fee probably rising to six% by early subsequent 12 months, such a stage, if realised, would imply mortgage charges have far additional to rise.

Read extra:

The resolution to bringing down inflation is a political nightmare for the Tories

Mortgage distress: What is inflicting the crunch, will it worsen and what are you able to do in case you are struggling?

‘Eyewatering’ hit to 1.4 million, primarily younger, mortgage clients forward, IFS warns

In making its fee resolution at present, the Monetary Policy Committee may face a giant break up in voting – although nearly all of opinion amongst commentators is {that a} quarter-point rise would be the consequence.

After all, the Bank has constantly steered markets away from their peak fee situations this 12 months and even signalled {that a} pause within the fee cycle was shut.

But the core perform of the MPC is to maintain inflation round a goal fee of two% – and there are indicators of frustration in Whitehall that the impartial Bank of England is lagging behind the curve.

So at a sticky 8.7% – and with wage progress and so-called core inflation (which strips out risky components equivalent to vitality and meals) ticking up final month – some is likely to be forgiven for pondering there was each justification for a 0.5 proportion level fee hike.

The different facet of the argument suggests a smaller rise can be ample as there may be proof that the 12 fee hikes so far, together with a pure easing in lots of prices, have been beginning to have an impact.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, mentioned wider knowledge instructed wage progress pressures would begin to cut back and that energy-linked inflation would fall sharply, permitting an easing of value progress extra broadly.

He mentioned of the MPC’s dilemma: “The headline rate of CPI inflation still looks set to fall sharply over the remainder of this year, probably to about 4.5% by December and to around 2% in the second half of 2024.”

He added: “We continue to think that the MPC will not raise Bank rate all the way to the near 6% level priced-in by markets before today’s data; for now, our base case remains Bank rate peaks at 5%.”

Content Source: information.sky.com