Ofgem’s newest announcement seems to supply some respite, however it’s higher off clients that stand to learn, whereas poorer households may find yourself paying extra.

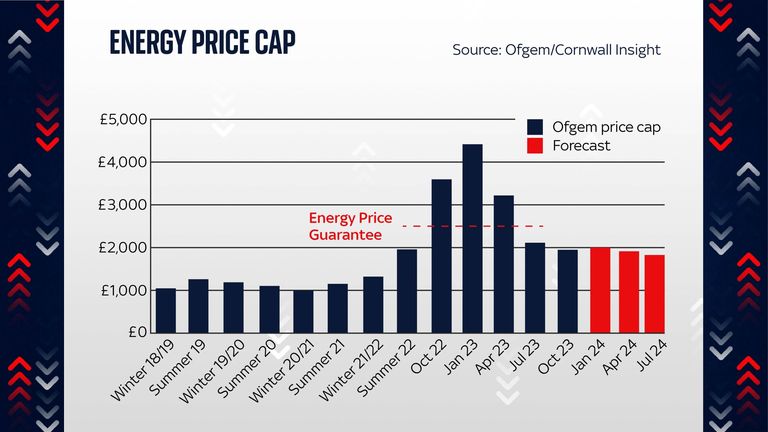

The regulator has lowered the value cap, which means a typical family will see their annual payments fall from £2,053 to £1,923.

It’s a transfer in the fitting course however the further money will shortly be absorbed by greater housing and grocery payments: month-to-month mortgage funds have spiked as rates of interest proceed to climb and meals costs are rising at an annual price of 14.9%.

The new stage can also be a lot greater than it was in October 2021, earlier than Russia’s invasion of Ukraine precipitated a worldwide vitality disaster.

Back then, the value cap got here in at £1,277.

It peaked at £4,279 in January, though authorities assist restricted the harm.

Ofgem stated households are decreasing their vitality utilization in response to greater payments – by round 7% per yr for electrical energy and 4% per yr for fuel. Under this new weighting, the value cap would truly are available at £1,823.

So, throughout the board, this winter shall be much less painful than the final.

However, with vitality payments nonetheless far above pre-crisis ranges at a time when housing and meals prices are rising, the monetary constraints on households are appreciable.

Poorer households would be the worst hit.

Not solely do they spend a bigger proportion of their disposable earnings on necessities, like vitality and meals, however the composition of the value cap additionally hurts them disproportionately.

That is as a result of, though unit costs for fuel and electrical energy have come down, the day by day standing cost that clients pay has been rising.

Read extra:

Energy value cap ‘costing cash and boosting inflation’

This is the mounted price that clients pay to have their properties linked to the grid.

These prices have climbed over the previous few years, partly as a result of additionally they embrace provider failure prices – round 30 suppliers have gone bust since vitality costs began to rise in 2021.

As this can be a mounted price there isn’t a benefit in reducing your family vitality utilization.

Even those who use little or no fuel and electrical energy must pay it, which means the system disproportionately advantages wealthier households with greater properties.

According to the Resolution Foundation, a left-leaning thinktank, the surge in standing costs – together with the withdrawal of some authorities assist packages – means greater than one-in-three households (7.2 million) throughout England can pay greater vitality payments this winter than final winter.

“As a result, the biggest falls in bills will be seen by households who use the most energy – while households who consume relatively little energy will face higher energy bills this winter than last” the Resolution Foundation stated.

It stated that the federal government’s coverage of providing price of dwelling funds totalling £900 to round eight million of the poorest households would battle to make a dent in the issue.

“The rising cost of other essentials – such as food bills, which are up by £960 on average since 2019-20 – mean this is unlikely to stop another winter of financial hardship,” it stated.

“The 2.3 million families in the poorest fifth of households who don’t receive benefits – and are therefore unlikely to be eligible for cost of living payments – could be hit hardest.”

Content Source: information.sky.com