It’s been a loopy few years for the price of many providers and necessities, with gasoline costs among the many payments enduring one thing of a roller-coaster journey.

Pump costs throughout the COVID pandemic sank as little as £1.07 a litre for petrol and £1.11 for diesel as demand fell off a cliff on account of lockdowns.

As the economic system reopened, prices rose sharply whereas Russia’s invasion of Ukraine noticed pump costs for each fuels hit report ranges nearer £2.

Today, costs are effectively beneath these peaks however, as RAC Fuel Watch knowledge has proven, August noticed unleaded rise by nearly 7p a litre, with diesel up by 8p.

Average prices are again above £1.50 for each and the hikes are set to be mirrored within the subsequent set of inflation figures which is able to doubtless place strain on PM Rishi Sunak’s pledge to halve the speed of inflation this yr.

The single greatest issue behind gasoline worth shifts is the price of oil.

At the guts of this, like in any market, is provide and demand – with some speculative buying and selling thrown in for good measure.

While Western economies don’t tolerate worth fixing behaviour, it’s on the coronary heart of the oil market and there’s no mechanism to cease it.

That is as a result of costs are largely on the mercy of the so-called OPEC+ cartel – a bunch of 23 oil-producing nations that account for greater than 80% of world crude reserves and greater than 40% of worldwide output.

The Saudi-led organisation, which incorporates Russia, units manufacturing targets aimed toward preserving costs properly worthwhile, reacting to international shocks and demand shifts, as acceptable, to satisfy their shared targets.

UK gasoline costs lag, typically by a number of weeks, the price of oil.

The current efficiency for Brent crude would counsel extra gasoline worth hikes are within the pipeline.

The contract for November supply stood at $88 a barrel on Monday.

Last month noticed a low of $84 and peak of $86 amid persevering with manufacturing cuts by Saudi Arabia and different members of the broader OPEC+ alliance to assist the market.

The newest spike is partly defined by expectations that the important thing OPEC+ gamers will, this week, prolong their manufacturing cuts to October.

The cartel’s cuts replicate worries {that a} slowing international economic system – largely a consequence of rising rates of interest to sort out inflation – is a threat to demand and, due to this fact, costs.

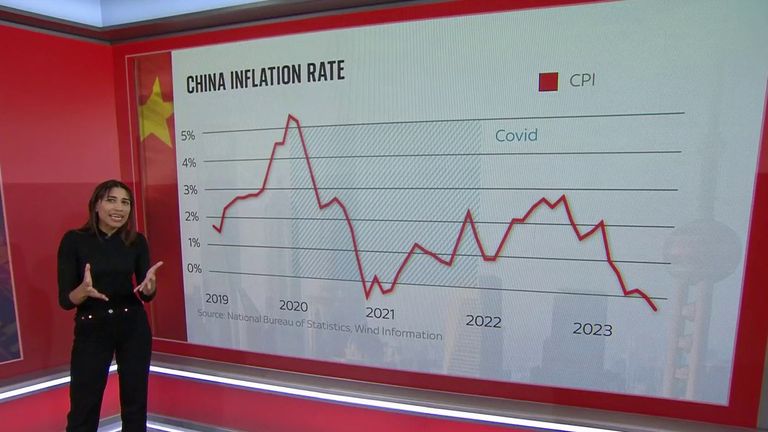

The explicit concern for members is the disaster going through China’s economic system, threatening a return to the pandemic-era when provide was outstripping demand.

But there’s each motive to consider that oil prices could also be close to their peak – barring any additional shocks.

Analysts say results from the height US vacation driving season are more likely to weigh on oil costs within the coming days now the summer season is over.

A current survey by the Reuters information company, which is impartial of OPEC+, additionally confirmed the primary month-to-month rise in output by the cartel since February throughout August.

When it involves gasoline costs, motoring teams have additionally expressed hope that current regulatory scrutiny on pump costs will proceed to weigh.

The RAC mentioned supermarkets had decreased gasoline margins again to pre-pandemic ranges since being rapped by the Competition and Markets Authority in July.

Its gasoline spokesman, Simon Williams, mentioned: “Wholesale costs for both petrol and diesel started to rise in late July on the back of oil hitting $85.

“While the barrel worth has stayed at that stage all through August, retailers had no selection however to cross on their elevated prices on the pumps.

“Fortunately for drivers though, they have clearly been influenced by the CMA’s investigation as, all of a sudden, margins are once again closer to their longer-term averages.

“It seems they used the wholesale worth rise to subtly cowl their tracks – in any case, massive reductions on the pumps quickly after the CMA’s findings have been introduced would maybe have been far too apparent a step.

“All we can hope is that this move by many big retailers back to fairer forecourt pricing remains when wholesale costs go down again. Only time will tell.”

The worrying actuality although is that whereas regulation can, and has, had an affect, in the end the facility over the costs we pay on the pumps is within the palms of a unregulated cartel.

Content Source: information.sky.com