Fixed mortgages charges have risen once more after a quick fall, newest figures present.

The common two-year house owner mortgage price available on the market edged again as much as 6.8% on Friday from 6.79% yesterday, monetary data firm Moneyfacts mentioned.

Five-year fixes have additionally risen barely again to six.32%, up from 6.31% on Thursday.

The fleeting dip was the primary time common mortgage charges had fallen for months.

The majority of UK mortgage holders are on fixed-rate offers.

More than 400,000 individuals had been anticipated to maneuver off present fastened offers between July and September, that means they’re possible to enroll to increased month-to-month repayments.

On Wednesday, it emerged inflation had slowed faster than anticipated, giving a glimmer of hope for under-pressure mortgage debtors.

The Office for National Statistics mentioned the patron costs index fell to 7.9% final month, down from 8.7% in May.

The Bank of England makes use of base price rises as a software to chill inflation.

Click to subscribe to the Sky News Daily wherever you get your podcasts

The central financial institution remains to be anticipated to lift rates of interest – at the moment at 5% – at its subsequent assembly on 3 August because it battles to carry inflation again to its 2% goal.

But consultants have mentioned the bigger-than-expected fall in inflation might see the Bank’s policymakers go for a smaller enhance of 0.25 proportion factors slightly than one other 0.5 proportion level rise.

Rachel Springall of Moneyfacts mentioned: “The mortgage market has seen some competitive deals surface this week, but it will be down to the borrower to decide whether now is the time to grab a deal or wait and see what may surface in the coming weeks.

“There are large hopes rates of interest on mortgages will fall, but it surely might take a couple of weeks for that type of sentiment to floor out there – particularly with one other base price choice on the horizon.”

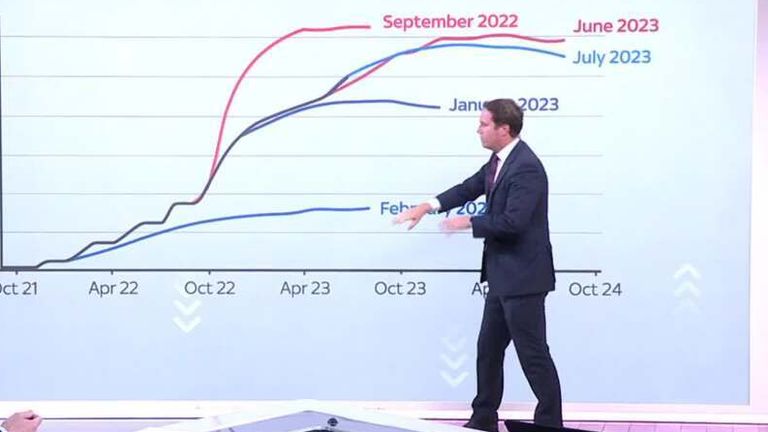

Overall, mortgage payments for anybody who has just lately agreed a brand new fastened price are nonetheless up markedly from the years of ultra-low rates of interest.

Less than two years in the past, in October 2021, the typical price on a five-year deal was simply 2.55%.

More than 2.4 million fixed-rate offers had been set to run out from summer season to the top of 2024, in accordance with banking business commerce physique UK Finance.

Content Source: information.sky.com