Higher for longer.

The Bank of England might have lifted rates of interest by lower than lots of people had been anticipating up till lately – up by 1 / 4 proportion level quite than a half – however for these with mortgages, probably the most putting factor from the trove of research they’ve revealed at the moment is not about at the moment however about tomorrow.

Because there are heavy hints dropped all through the Bank’s Monetary Policy Report that it expects borrowing prices to remain excessive for lots longer than many had anticipated.

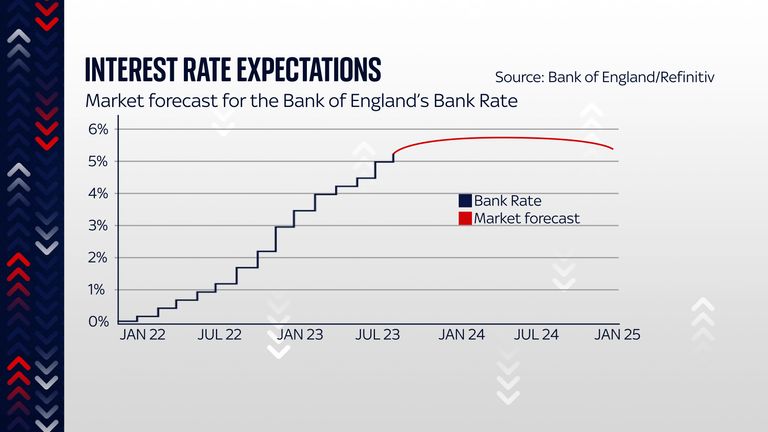

Only a couple of months in the past monetary markets had been betting that the Bank Rate – the official borrowing stage set at Threadneedle Street – can be all the way down to 4% by 2024 and three.7% by 2025. Far greater than the post-financial disaster interval however a fall all the identical.

Now, those self same markets assume charges will nonetheless be at 5.9% in 2024 and at 5% by 2025. And quite than difficult these assumptions, the Bank has come as shut as potential to reinforcing them.

This establishment would not present specific steerage about the place it is anticipating rates of interest to go; it prefers to drop hints. And the trace within the minutes alongside the choice at the moment was about as heavy as you may get.

“The [Monetary Policy Committee] would ensure that Bank Rate was sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

Higher for longer, in different phrases.

Why? Another clue is to be discovered elsewhere within the Bank’s forecasts at the moment. It’s price quoting at size: “Sharp will increase in vitality, meals and different import costs over the previous two years have had second-round results on home costs and wages.

“These second-round effects are likely to take longer to unwind than they did to emerge and the Monetary Policy Committee has placed weight in its recent forecasts on the risk that they might persist for longer.

“The committee now judges that a few of this threat might have begun to crystallise.”

It fears, in different phrases, that the inflation cat is now out of the bag. And thus getting worth rises to return down might contain significantly extra work on its half than it beforehand anticipated. Higher for longer.

Which after all means ache for a lot of households – particularly these with mortgages and people renting (most landlords even have mortgages).

And in contrast to earlier eras the place most households had been on floating charge mortgages and thus that ache was in a short time felt of their pockets, at the moment that ache is being drip fed into the financial system as two and 5 yr fixed-rate mortgages regularly expire and are changed with far dearer month-to-month funds.

Read extra from enterprise:

Why renters are extra weak to rate of interest rises

Effects of rate of interest hikes pushing financial system in direction of ‘recession’

The squeeze on renters is a symptom of Britain’s housing disaster

Again, meaning the affect of those rate of interest will increase goes to be an extended, drawn-out affair. And you’ll be able to see the implications within the Bank’s financial forecast. The financial system is not more likely to face a recession, a minimum of based on its central projection.

But it should basically flatline – depressed by these greater charges – for 3 years, not displaying significant development till 2026.

It is a miserable prospect. Perhaps one of the best factor to hope for is that the Bank is flawed. This has occurred earlier than – certainly it is already submitting to an impartial inquiry into the way it didn’t foresee the latest spike in inflation, led by former Federal Reserve chairman Ben Bernanke.

It’s not altogether implausible that they fail to foresee a extra significant financial restoration.

Content Source: information.sky.com