The proprietor of British Gas has revealed it expects income for its family provide enterprise to return in “significantly higher” over the primary half of the 12 months.

Centrica made the announcement forward of its annual normal assembly (AGM) the place bosses are anticipated to face an investor revolt over a pay report that features a close to five-fold improve within the bundle awarded to chief govt Chris O’Shea.

The firm stated in its replace that the anticipated revenue hike in its retail division, which incorporates British Gas, was primarily right down to a discount in debt-related prices quite than any buying and selling windfall from document costs.

Energy regulator Ofgem’s value cap gives an allowance to account for debt on vitality payments that can not be recovered by suppliers and is in the end written off.

Households have confronted unprecedented payments because of rising wholesale costs linked to the battle in Ukraine however have been protected against the worst by way of authorities support.

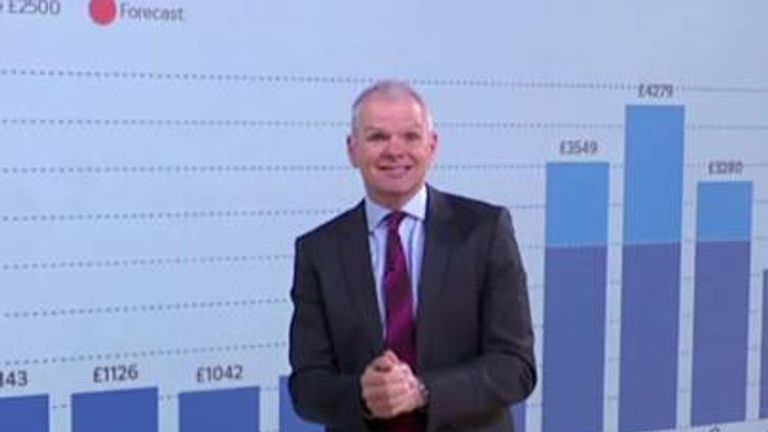

The present Energy Price Guarantee, which ends this month, means annual vitality prices have been restricted to £2,500 for the typical family.

Plunging wholesale prices for pure fuel and electrical energy will depart the vitality value cap, which returns from July, at an annual common of £2,074 between July and September.

Centrica stated its group efficiency over the primary 5 months of the 12 months had been sturdy general regardless of these reductions in wholesale costs.

It stated group adjusted earnings per share have been set to be on the “top end” of analyst expectations for the 12 months of a predicted vary between 16.5 and 24.7 pence per share.

Centrica stated its vitality advertising and buying and selling enterprise, together with fuel manufacturing volumes, had offset the affect of falling commodity costs.

In a press release, the agency stated: “As always, uncertainties remain over the balance of the year, including the impacts of weather, commodity prices, the economic environment, any changes to regulation or government policy, asset performance and the competitive backdrop for our energy supply businesses.”

Shares have been down greater than 1%.

While Centrica is anticipated to win the motions set out at its AGM, asset supervisor Abrdn has reportedly stated it could vote in opposition to the group’s pay report for high administration.

Mr O’Shea took house £4.5m for 2022 on the again of document income.

While the sum represented a five-fold improve in rewards on the valuable 12 months, that was partly defined by the very fact he had declined a bonus in 2021.

Content Source: information.sky.com