Chinese authorities have unveiled contemporary measures geared toward propping up investor confidence within the nation’s inventory market.

The most important securities regulator, the China Securities Regulatory Commission, mentioned it could introduce a lot of measures aimed making it simpler to commerce.

These embrace cuts in the price of buying and selling, through a discount within the dealing with charges charged by brokers, in addition to a leisure of the principles governing share buybacks – making it simpler for firms to purchase again their shares.

The regulator indicated it’s also trying into extending buying and selling hours for the nation’s inventory and bond markets and a potential lower in stamp obligation on share trades.

The measures observe sharp reverses this month in each inventory and bond markets amid a weakening of confidence amongst traders.

The CSI 300 index of huge cap shares has fallen by almost 6% over the last fortnight and is exhibiting a loss for 2023 up to now whereas in Hong Kong the Hang Seng index, which is filled with Chinese shares, has this week suffered its largest weekly fall in two months and is now in bear market territory (in different phrases it’s down by greater than a fifth from its most up-to-date peak).

This lack of confidence displays a lot of components – most of that are certain up in China’s deteriorating financial outlook.

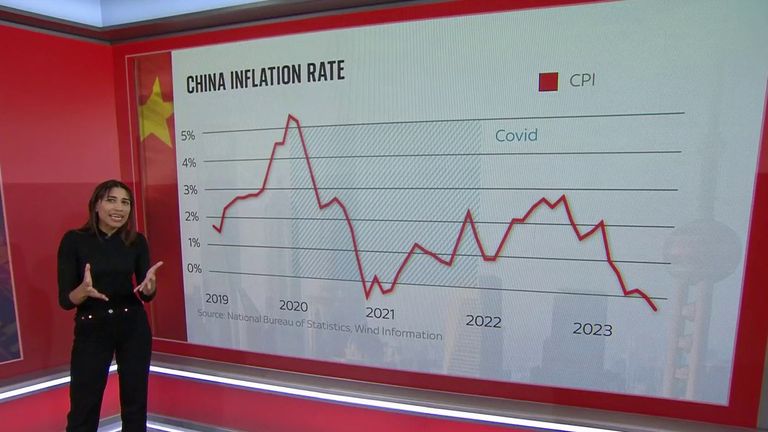

It emerged final week that the world’s second largest economic system has lurched into deflation, the phenomenon during which costs persistently fall, miserable spending by households and companies.

Growth is faltering, with exercise depressed in each providers and manufacturing, whereas China’s huge exporters are underneath strain amid weakening demand from the West.

This is partly a mirrored image of customers spending extra on experiences, akin to journey and consuming out, than on manufactured items, since economies reopened after the pandemic.

The youth drawback

Consumer confidence in China itself stays weak, partly due to deflation, whereas there are additionally rising considerations in regards to the ranges of youth unemployment within the nation.

Read extra:

Economic headache brought on by China deflation – and worldwide results

Falling costs in China may simply be unhealthy for everybody

While the headline unemployment price in China in June – the most recent month for which figures can be found – stood at 5.3%, for these within the 16-24 age bracket it’s at present 21.3%, having risen in every of the final six months.

The authorities has since mentioned that it’ll cease publishing separate figures for youth unemployment however the improve raises the chance of social unrest in a few of China’s huge cities.

The issues partly replicate rising expectations amongst China’s younger – of whom 11.6 million graduated from school or college this 12 months – who’re more and more reluctant to take up the customarily tiring bodily work that their mother and father did.

They would favor to work in additional highly-paid roles however, as a result of sluggish progress within the broader economic system, not sufficient of those jobs are being created.

So many younger graduates are opting as a substitute both to not work or to take up a collection of short-term roles that see them drifting out and in of the labour market.

The People’s Bank of China sought to answer a few of these points this week by reducing a lot of its key rates of interest.

Property market considerations

But the most recent lurch downwards in markets this week displays an extra issue, specifically contemporary considerations over China’s property market, as soon as a serious driver of progress within the economic system however now a drag on it.

While a lot of main property builders have defaulted on their money owed in latest instances, final week introduced information of issues at Country Garden, China’s largest personal housebuilder.

The firm reported a 60% year-on-year fall in gross sales for July and likewise admitted it had missed greater than $13m price of curiosity funds on its bonds – which it’s now in search of to search out. The information got here as a shock as a result of Country Garden was considered a extra conservatively run enterprise than its rival Evergrande – which has been teetering on the brink of collapse for 2 years.

Unlike Evergrande, which was aggressively run, Country Garden had decrease money owed.

However, the corporate – which specialises in inexpensive housing – has been caught out by its extra outstanding positioning in smaller and fewer developed cities in China, the place home costs have fallen extra quickly over the last 12 months or so than they’ve within the massive conurbations.

Evergrande, in the meantime, has in a single day utilized for chapter safety within the US courts because it seeks to restructure its billions of {dollars}’ price of money owed.

The woes at Country Garden, specifically, have revived fears that issues in China’s property sector may end in contagion to the broader economic system and, specifically, the monetary sector.

There can also be a hazard that they additional depress sentiment in direction of the housing market, the place exercise has been stifled in latest months, regardless of makes an attempt by the authorities late final 12 months to stimulate exercise.

Some analysts suspect the scenario at Country Garden, which was at this time dropped as a constituent of the Hang Seng, might not be all unhealthy information if it prompts the federal government to introduce contemporary financial stimulus.

Jennifer McKeown, chief international economist at Capital Economics, instructed purchasers this week that Beijing could possibly be anticipated to backstop Country Garden if its issues appeared like spiralling right into a full-blown credit score crunch.

But she added: “The far bigger issue which the Country Garden turmoil highlights is that China’s construction sector is in structural decline which policymakers will be unable to prevent.

“This will contribute to a slowdown in its GDP progress to 2% by 2030, which is a key theme that has lengthy formed our long-run international forecasts.”

There are already signs that the slowdown in the property market is leading to contagion elsewhere.

One of the reasons why the authorities announced market-friendly measures today is that a row has erupted around Zhongrong International Trust, a wealth management business, which has missed payments on a number of investment products during the last month.

Up to 30,000 investors are thought to have been affected and the missed payments could be as high as $27bn.

It is an unpleasant cocktail of events.

Two years ago, when problems around Evergrande blew up, there was widespread talk of China struggling a ‘Lehman second’.

That appeared misplaced on the time – however it’s no shock to see such speak circulating as soon as once more amongst traders.

Content Source: information.sky.com