The power regulator has threatened motion in opposition to family suppliers in the event that they put traders earlier than hard-pressed households.

Ofgem’s chief govt Jonathan Brearley warned that monetary practices seen earlier than the power disaster wouldn’t be tolerated.

New guidelines had been introduced in final November to bolster the resilience of enterprise fashions after the collapse of greater than 20 suppliers when Russia’s invasion of Ukraine prompted a spike in wholesale power prices.

Mr Brearley used an open letter to power corporations to remind them of their obligations together with a requirement to carry on to additional cash or property to cut back the chance of them going bust, decreasing the fee and disruption of failure within the course of.

It was written as the price of fuel and electrical energy returned to the power worth cap defend from the start of the month following the top of the federal government’s power worth assure.

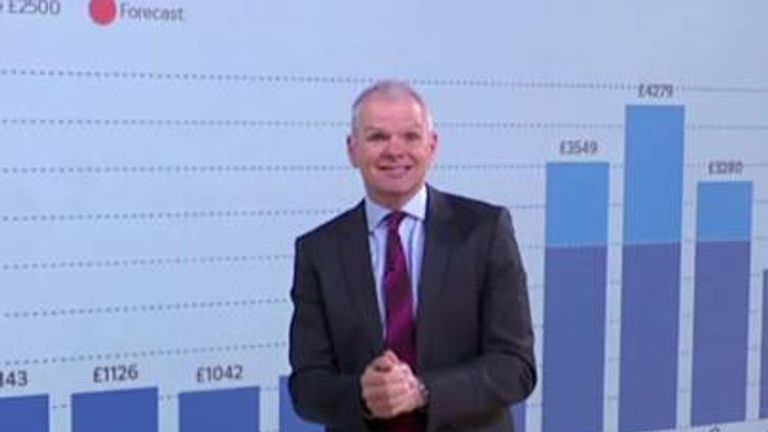

The cap – at just under £2,100 for a typical family – displays a discount in the price of wholesale power for the reason that peaks of 2022 and early 2023.

Ofgem expects the family provide sector to return to revenue this 12 months after 5 years of losses.

Mr Brearley wrote: “An energy sector where companies can make a reasonable profit is important to create a sustainable and competitive market for consumers.

“However, a return to the practices we noticed earlier than the power disaster is not on the desk – suppliers should reciprocate the help the sector was given by customers and taxpayers when wholesale costs elevated by behaving responsibly as costs fall and earnings return.

“The power market has modified. Ofgem has launched main modifications to the market, and we’d like suppliers to study the teachings of the power disaster and play their half by ensuring they’re financially strong, can take in potential losses and are assembly our new capital necessities.

“I expect no return to paying out dividends before a supplier has met those essential capital requirements.”

Mr Brearley added that the regulator was intently monitoring suppliers to be sure that costs remained aggressive and weak prospects had been being protected.

Ofgem’s guidelines had been criticised by some within the sector for not going far sufficient.

Centrica, the proprietor of British Gas, had argued as an example that Ofgem ought to have ensured all buyer credit score balances are ringfenced so customers and corporations are shielded from further prices within the occasion of a provider failure.

The coming winter is ready to stay robust for bill-payers as the worth cap, that limits the quantity suppliers can cost for every unit of fuel and electrical energy, is predicted to stay across the £2k stage.

Energy trade consultancy Cornwall Insight stated final week it believed that, based mostly on present market pricing and Ofgem’s standards, the worth cap will fall to £1,978.33 from October from July’s £2,074.

It predicted the cap would rise once more from January, to £2,004.40, reflecting the time of typical peak demand.

Content Source: information.sky.com