The rate of interest within the 20 Eurozone international locations has been returned to the best ever degree.

Not since October 2000, when the euro was newly launched, have charges been at this all time excessive.

On Thursday, the European Central Bank (ECB) elevated its benchmark fee to three.75%, up 0.25 proportion factors, making borrowing costlier as inflation stood at 5.5% within the 12 months as much as June.

It was the ninth consecutive rise because the ECB president, Christine Lagarde, mentioned inflation will stay above goal for an prolonged interval however finally come down.

Commentators had thought an increase in July would imply a holding of charges in September. Ms Lagarde mentioned the speed setters had an “open mind” on the September resolution and would comply with the financial knowledge, equivalent to financial development and inflation figures.

“We might hike and we might hold”, she mentioned.

A blended financial outlook was forecast for the Eurozone because the close to time period forecast deteriorated as a result of weaker home demand, excessive inflation and financing dampening circumstances.

While unemployment was at a historic low, Ms Lagarde mentioned this pattern could gradual.

Similar to the UK, revenue margins had been recognized as being a driver of inflation by Lagarde as power costs fell. External worth stress had been not the primary driver of inflation and had been over taken by home elements equivalent to increased wages.

Governments had been additionally advised by Lagarde they need to “promptly” roll again power assist measures as a result of falling costs.

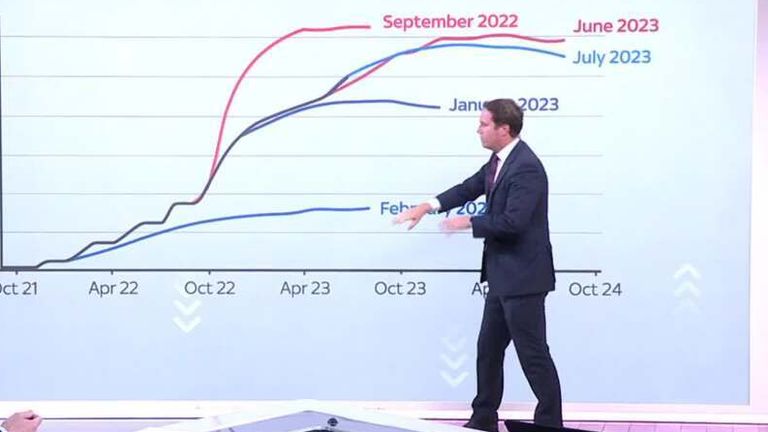

Across the world rates of interest have been elevated to take cash out of the financial system and produce down worth rises.

Most just lately the US central financial institution, generally known as the Fed, recommenced its programme of rises after a pause.

Interest charges have risen to five% within the UK too, and are anticipated to go even increased, as inflation proved to be cussed.

Inflation turned a worldwide drawback after the Russian invasion of Ukraine resulted in hovering gasoline and oil costs.

Content Source: information.sky.com