Ed Richards, the previous boss of media regulator Ofcom, is appearing as a secret lobbyist for RedBird IMI, the Abu Dhabi-backed media automobile which is in superior talks to take management of The Daily Telegraph.

Sky News has learnt that Flint Global, the general public affairs agency based by Mr Richards, is advising RedBird IMI on its curiosity within the Telegraph newspapers and Spectator journal.

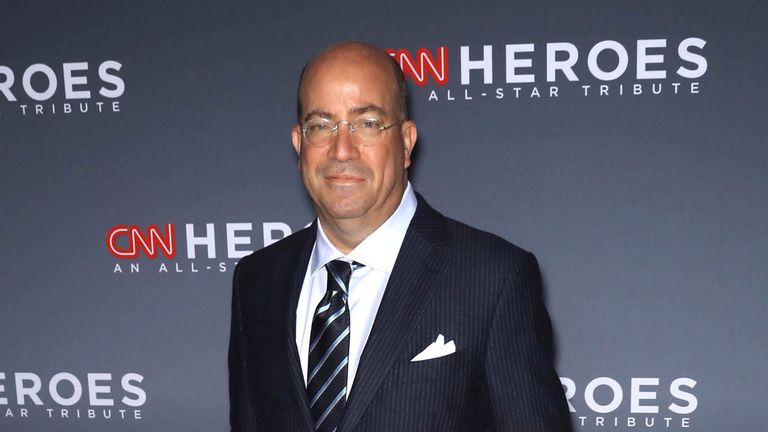

RedBird IMI, which is headed by the ex-CNN president Jeff Zucker, confirmed on Monday Sky News’ unique revelation from final week that it’s backing the Barclay household’s efforts to thwart a wider public sale of the titles.

City sources mentioned that Flint Global had been employed due to Mr Richards’ observe report of involvement in public curiosity intervention notices (PIINs) – authorities probes carried out by the media and competitors watchdogs which may result in offers being blocked.

In latest weeks, calls to dam majority international possession of the Telegraph have gathered tempo as MPs and friends – predominantly from the Conservative Party – have raised considerations about Gulf funding of the newspapers.

Neil O’Brien, the MP for Harborough, mentioned on Friday: “The Telegraph and Spectator are two of our most prestigious publications.

“Naturally there’s curiosity from world wide in gaining management of them.

“I hope [the government] will scrutinise the financing and ownership structure of any deal closely and put them through the usual PIIN process.”

A courtroom listening to to liquidate a Barclay household holding corporations with a view to easy a sale of The Daily Telegraph was adjourned on Monday following a proposal to repay in full greater than £1.1bn to Lloyds Banking Group.

The household hopes to ship a full compensation of the debt by the top of the month.

The adjourned courtroom listening to can be anticipated to happen shortly after that date if the Barclays fail in that goal.

Initial presents for the Telegraph and Spectator are due on 28 November, with the billionaire hedge fund tycoon Sir Paul Marshall and Daily Mail proprietor Lord Rothermere among the many potential bidders.

However, the emergence of a doubtlessly imminent deal between the Barclays and Lloyds threatens to derail the public sale, in response to a number of sources.

RedBird IMI mentioned on Monday that it might convert the £600m of loans to the household into fairness “at an early opportunity”.

That assertion seems to undermine the Barclays’ earlier declare that its financing companions would merely be offering debt funding, and that there was due to this fact no justification for ministers to problem a PIIN.

“Under the terms of this agreement, RedBird IMI has an option to convert the loan secured against the Telegraph and Spectator into equity, and intends to exercise this option at an early opportunity,” it mentioned.

“Any transfer of ownership will of course be subject to regulatory review, and we will continue to cooperate fully with the government and the regulator.”

RedBird IMI plans to lend roughly £600m to the household, with the stability of the debt being funded by a member of the Abu Dhabi royal household – mentioned to be Sheikh Mansour bin Zayed Al Nahyan – the final word proprietor of a controlling stake in Manchester City Football Club.

The debt compensation however stays topic to due diligence by Mr Zucker’s automobile.

The Barclays have made a collection of elevated presents in latest months to move off an public sale, elevating its proposal final month to £1bn.

Lloyds, nevertheless, has repeatedly advised the household and its advisers that they need to both repay the debt in full or take part within the public sale alongside different bidders.

Talks orchestrated by Goldman Sachs, the funding financial institution, have now kicked off with potential consumers, who additionally embrace the London-listed media group National World.

Until June, the newspapers had been chaired by Aidan Barclay – the nephew of Sir Frederick Barclay, the octogenarian who alongside along with his late twin Sir David engineered the takeover of the Telegraph 19 years in the past.

Lloyds had been locked in talks with the Barclays for years about refinancing loans made to them by HBOS previous to that financial institution’s rescue through the 2008 banking disaster.

The household’s debt to Lloyds additionally contains some funding tied to Very Group, the Barclay-owned on-line buying enterprise.

Ken Costa, the veteran City banker who suggested the Barclay brothers on their buy of the Telegraph in 2004 and counts the sale of Harrods to Qatar Holding amongst his different flagship offers, is appearing as a strategic adviser to the household.

The Telegraph and Spectator disposals are being overseen by a brand new crop of administrators led by Mike McTighe, the boardroom veteran who chairs Openreach and IG Group, the monetary buying and selling agency.

Mr McTighe has been appointed chairman of Press Acquisitions and May Corporation, the respective dad or mum corporations of TMG and The Spectator (1828), which publish the media titles.

In July, Telegraph Media Group (TMG) printed full-year outcomes displaying pre-tax income had risen by a 3rd to about £39m in 2022.

A profitable digital subscriptions technique and “continued strong cost management” had been cited as causes for the corporate’s earnings development.

“Our vision is to reach more paying readers than at any other time in our history, and we are firmly on track to achieve our 1 million subscriptions target in 2023 ahead of our year-end target,” mentioned Nick Hugh, TMG chief government..

“RedBird IMI are entirely committed to maintaining the existing editorial team of the Telegraph and Spectator publications and believe that editorial independence for these titles is essential to protecting their reputation and credibility,” it mentioned in Monday’s assertion.

“We are excited by the opportunity to support the titles’ existing management to expand the reach of the titles in the UK, the US and other English-speaking countries.”

Mr Richards couldn’t be reached for remark.

Content Source: information.sky.com