An estimated 1.4 million mortgage holders – half of them aged underneath 40 – may lose greater than 20% of their disposable earnings as charges rise, in line with a revered thinktank.

The Institute for Fiscal Studies (IFS) mentioned it was an “eyewatering” prospect in a “serious shock” for the market, with 8.5 million individuals doubtlessly having to spend a fifth of their earnings on mortgage funds.

It issued the warning as Bank of England policymakers put together to lift the bottom fee once more to deal with inflation within the UK economic system.

Inflation newest updates: One determine inside information is ‘deeply worrying’

The financial coverage committee was broadly anticipated, earlier than the discharge of the newest inflation information on Wednesday, to go for a 0.25 proportion level improve – its thirteenth consecutive hike – to 4.75% on Thursday.

However, the truth that it got here in hotter than anticipated has meant monetary market individuals are actually break up on whether or not the rise might be sharper – taking Bank fee to five%.

The inflation information, coupled with a surge in primary pay, has pushed up expectations over the previous month that the Bank should keep its fee rises for longer than anticipated, to probably as excessive as 6%.

That has made funding prices costlier over the previous few weeks, forcing mortgage lenders to reprice their house mortgage choices and making them costlier within the course of.

It prompted a warning from the Resolution Foundation on the weekend that common annual mortgage repayments have been set to rise by £2,900 for these renewing subsequent yr.

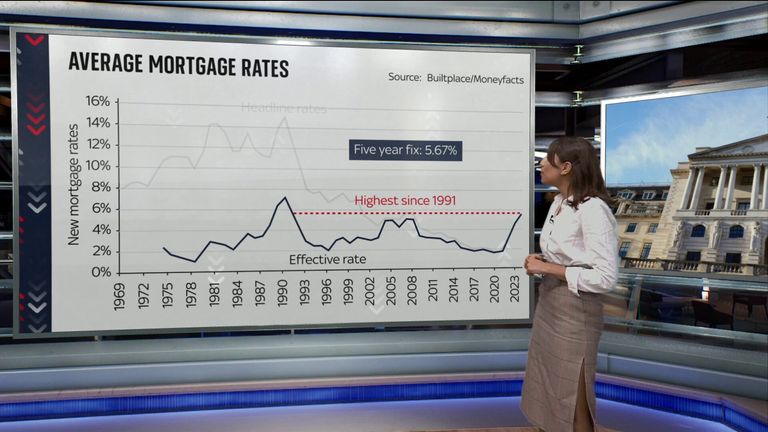

Since March 2022, the common two-year mounted fee mortgage has risen from 2.65% to past 6%.

The IFS analysis advised that if charges remained that top, at ranges not seen for nearly 15 years presently, these of their 30s confronted the best ache.

It mentioned that round 1.4 million mortgage holders – half of whom are underneath 40 – would see their funds rise by at the least 20% of their disposable earnings.

People in London and southern England would see the largest hits to their disposable incomes in proportion phrases, the report mentioned, as a result of mortgage values have been increased relative to earnings.

“After this rise, around 60% of the 14 million with a mortgage (i.e. 8.5 million adults) will spend at least a fifth of their income on mortgage payments”, the examine concluded.

“This is a substantial increase. In March 2022, only 36% of those with a mortgage (5.1 million) paid at least this much of their incomes.”

Surging mortgage prices have prompted calls for presidency help however Chancellor Jeremy Hunt has dominated that out for concern that handouts would solely feed inflation by inserting more cash in individuals’s pockets.

Read extra:

Stubbornly excessive inflation will increase strain for rate of interest hike

Inflation fee rises are turning right into a sticky phenomenon – and there are a number of apparent penalties

He advised MPs on Tuesday that he can be assembly precept mortgage lenders later this week to ask what assist they may give to struggling debtors.

IFS analysis economist Tom Wernham mentioned: “Many families bought homes – often with sizable mortgages – when

interest rates were very low. As people’s fixed term offers come to an end they are going to be exposed to much higher interest rates.

“For many, the increase in monthly repayments is going to come as a serious shock – on average it will be equivalent to seeing their disposable income fall by around 8.3%. And for 1.4 million mortgage holders – half of whom are under 40 – mortgage payments are set to rise by an eyewatering 20% of disposable income or more.

“Given the price of dwelling pressures persons are already dealing with as a result of excessive meals and power value inflation, these important will increase in mortgage prices couldn’t come at a worse time.”

Content Source: information.sky.com