The prime minister and his chancellor discover themselves in one thing of a conundrum.

They have dedicated themselves to halving inflation this yr – with out referring to the very fact that is truly one thing the politicians outsourced to the Bank of England 25 years in the past – even, if the chancellor is to be believed, this comes on the value of a recession.

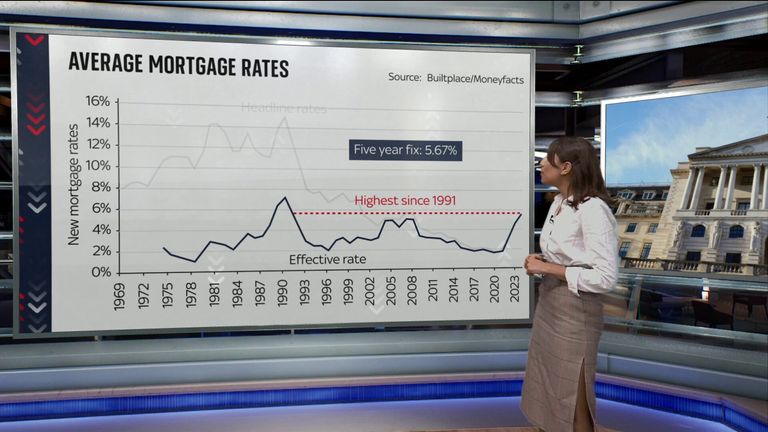

At the identical time, nonetheless, they wish to see this being performed with out an excessive amount of ache for householders whose mortgage charges are spiralling ever increased.

Accordingly, Jeremy Hunt can be welcoming, if that’s the proper phrase, executives from the monetary providers business to 11 Downing Street on Friday to debate methods of serving to householders with their mortgages.

That poses a very tough downside: the right way to mitigate the impression of upper rates of interest whereas doing nothing to blunt their impression on the broader financial system within the battle in opposition to inflation.

Several attainable options are already doing the rounds.

One concept, mooted by some Conservative backbenchers, has already been dismissed by the chancellor. This can be to disinter Mortgage Interest Relief At Source (MIRAS).

This was a scheme initially launched by Roy Jenkins, a former Labour chancellor, in 1969 as a means of encouraging residence possession. It enabled householders to set a portion of the curiosity payable on their mortgages in opposition to their earnings tax invoice.

It was a very priceless tax break at a time when private tax charges have been so excessive. In 1983 underneath Sir Geoffrey Howe, a former Conservative chancellor, the allowance on which aid could possibly be claimed was elevated and prolonged to permit {couples} with joint mortgages to pool their allowances.

This latter perk was abolished by his successor Nigel Lawson in 1988, however the determination to pre-announce the transfer led to a rush of individuals borrowing extra. It contributed to the housing market crash that started in late 1989.

By then, MIRAS was already a sizzling potato, not least as a result of its value.

An inquiry by the National Federation of Housing Associations, chaired by the late Prince Philip, really helpful scrapping MIRAS as way back as 1985 – however was squashed by ministers nicely conscious of its recognition.

Margaret Thatcher, the prime minister of the day, informed the House of Commons on the day the report was revealed: “So long as I am here, mortgage tax relief will continue.”

But the rising value of MIRAS – and its means to stoke home value inflation – meant its days have been numbered.

Ken Clarke, chancellor from 1993 to 1997, wished to abolish the tax break however was prevented from doing so by his celebration’s MPs. That was left to Gordon Brown, who abolished MIRAS in 2000, arguing it was a middle-class perk.

Mr Brown’s considering was echoed this week by Mr Hunt.

It is tough to assume how any chancellor may pretty supply a beneficiant tax break to homebuyers whereas not additionally offering monetary assist to the thousands and thousands of renters additionally battling elevated dwelling prices. Reviving MIRAS would even be unaffordable when the federal government is routinely borrowing huge sums – in addition to risking additional stoking home value inflation.

It can be questionable whether or not MIRAS would make that a lot of a distinction to the funds of householders battling their mortgages.

By the time Mr Brown abolished it, successive governments had already trimmed its generosity, to the extent that it was price solely £24 per 30 days to the common house owner – and, even then, it nonetheless value the Treasury getting on for £2bn in right now’s cash. A extra beneficiant scheme would value significantly extra.

Read extra:

The resolution to bringing down inflation is a political nightmare for the Tories

Mortgage distress: What is inflicting the crunch, will it worsen and what are you able to do if you’re struggling?

‘Eyewatering’ hit to 1.4 million, primarily younger, mortgage prospects forward, IFS warns

Rachel Reeves, the shadow chancellor, has provide you with a bundle of 5 proposals that will require lenders to permit debtors battling their mortgage to briefly swap to interest-only funds; to permit debtors to elongate the time period of their mortgage interval; to reverse any assist measures when the borrower requests; to attend a minimal of six months earlier than initiating repossession proceedings, and ordering the Financial Conduct Authority to make sure any house owner benefiting from such strikes wouldn’t harm a borrower’s credit standing.

Those proposals, because it occurs, should not that totally different from the form of measures that UK Finance, the business physique for the monetary providers sector, envisages being applied if extra householders do begin to battle with mortgage funds.

It has mentioned lenders stand prepared to supply “part payment” plans, underneath which debtors pay a lowered quantity protecting the curiosity and among the mortgage quantity, or mortgage time period extensions the place the size of the mortgage is prolonged to scale back the month-to-month compensation quantity. It too can be providing short-term switches to interest-only mortgages and fee concessions the place acceptable.

The similarity between the business’s proposals and people made by the shadow chancellor isn’t a coincidence. Earlier in her profession, Ms Reeves labored for Halifax, the UK’s greatest mortgage supplier, the place in the course of the international monetary disaster she witnessed first-hand the ache that was being felt by householders as mortgages turned extra scarce.

Both units of proposals can be seen as pragmatic and never least as a result of they don’t indicate an increase in authorities spending.

Another proposal, favoured by, amongst others, the Housing Secretary Michael Gove, is for the widespread take-up of 25 or 30-year mortgages alongside the strains of these widespread within the US.

This, like bringing again MIRAS, isn’t a very new concept.

Mr Brown commissioned David Miles, a former member of the Bank of England’s Monetary Policy Committee, to look into the viability of longer-term fixed-rate mortgages as way back as 2003.

Such mortgages do exist already and are offered by specialist lenders.

But take-up of such merchandise has been low as a result of prospects have tended, prior to now, to not regard them pretty much as good worth. Were the federal government trying to encourage take-up, there are additionally structural points within the mortgage market that would wish addressing.

In the UK, banks finance mortgages utilizing the deposits of savers. In the US, lenders borrow to finance the mortgages they supply, with government-sponsored our bodies like Fannie Mae and Freddie Mac parcelling up their residence loans and promoting them on.

Something like that may be wanted right here have been there to be widespread take-up or 25 or 30-year mortgages.

There can be a cultural issue at play right here. British mortgage debtors are extra culturally attuned to buying round for shorter-dated mounted price offers than making use of for 25 or 30-year mortgages. They additionally are inclined to borrow as a lot as they will when taking out a mortgage. In European nations – the place longer-dated mortgages are extra widespread than within the UK, equivalent to France – there are usually fairly strict limits on how a lot might be borrowed.

So do not fall for considering there’s a magic bullet to unravel the issues of householders struggling to maintain up their mortgage funds.

The greatest that may be hoped for, possibly, is bigger flexibility on the a part of lenders.

Content Source: information.sky.com