The pound can purchase extra {dollars} than at any level within the final 15 months after the US fee of inflation slowed to its lowest fee in additional than two years.

One pound purchased $1.30 on Wednesday afternoon, the very best quantity since April 2022 because the greenback weakened.

A stronger, extra priceless pound means importing items – akin to meals and petrol – turns into cheaper.

Cheaper import prices may also help deliver inflation down as prices for companies and households are diminished.

The rise in worth follows announcement of the bottom US inflation figures in additional than two years.

Official US figures confirmed the patron worth index (CPI) measure of inflation stood at 3% in May. While costs are nonetheless persevering with to rise, the speed is decrease than economists had anticipated and simply above the Federal Reserve’s – US central financial institution’s – 2% goal.

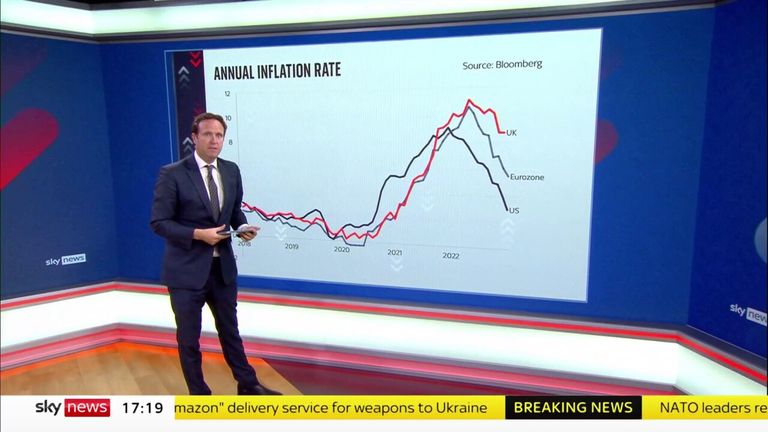

The UK is an outlier when its fee of inflation is in comparison with the US and eurozone charges. Its CPI fee stood at a cussed 8.7% with core inflation – the speed of costs rises excluding meals and gas – rising to 7.1%.

Inflation within the 20 international locations utilizing the euro reached 6.1% in May, newest information confirmed.

The subsequent transfer for the Federal Reserve, in response to the inflation announcement, is unclear. It had been anticipated to extend rates of interest in two weeks time, after holding charges final month.

Central banks internationally have upped rates of interest, making the price of paying debt – akin to mortgages or bank cards – dearer in an effort to take cash out of the financial system and dampen inflation.

In the UK the Bank of England is more likely to improve charges by 0.5 proportion factors because of the excessive inflation fee.

The pound has additionally elevated in opposition to the euro with £1 shopping for €1.16.

The UK inflation fee for June is to be introduced on Wednesday subsequent week.

Content Source: information.sky.com