Blimey.

The Bank of England was at all times going to enhance its Bank charge this month. But each economist had anticipated solely 1 / 4 share level enhance.

There was good motive for this.

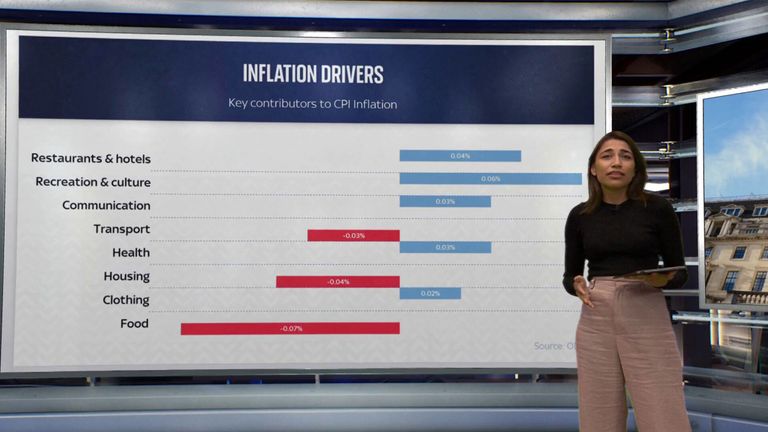

Although inflation knowledge had been larger than anticipated this week, the financial institution had been slowing down the speed at which it was lifting borrowing prices. So too had its counterpart central banks around the globe, most notably the Federal Reserve within the US and the European Central Bank.

Typically 1 / 4 share level enhance is taken into account a “normal” enhance. And whereas some buyers had begun to wager on an even bigger charge enhance this month, most individuals anticipated one other regular enhance.

Well, the financial institution’s financial coverage committee (MPC) has stunned them with an even bigger enhance.

It’s an indication, if any have been wanted, of simply how nervous it’s about inflation, which appears like it’s turning into dangerously sticky.

The stickier it will get, the tougher inflation is to deliver down, therefore why the financial institution is taking this extra radical step.

It is a type of shock remedy that it hopes will ship out a transparent message: relating to inflation-fighting, it is not messing round.

The downside is that some will depict it as a type of panic.

The financial institution has been roundly criticised for failing to forecast the sharp enhance in inflation within the final couple of years. It has been criticised for being too gradual to reply. Now it’s responding much more shortly, however some will argue that this can be a downside of its personal making.

And a rise like it will have a bearing on households. For as financial instruments go, rates of interest are a very blunt instrument.

Cutting them encourages all types of financial exercise – some good, some dangerous. It incentivises folks to borrow extra, generally to extra. But it additionally encourages funding in necessary components of the economic system.

Indeed, you would make the case that the gorgeous go we’re in in the mean time, with so many households so delicate to even a comparatively small enhance in charges – with the upshot that 6% mortgage charges really really feel rather a lot like 15% charges did within the early Nineteen Nineties.

In a lot the identical means, elevating rates of interest is a little bit like bludgeoning the economic system. It helps to scale back inflation, by making it significantly much less engaging to borrow and splurge. But by the identical token it additionally causes extreme harm to many households. It creates collateral harm.

Read extra:

The resolution to bringing down inflation is a political nightmare for the Tories

Mortgage distress: What is inflicting the crunch, will it worsen and what are you able to do in case you are struggling?

‘Eyewatering’ hit to 1.4 million, primarily younger, mortgage clients forward, IFS warns

That is the dilemma going through the Bank of England proper now. It is aware of that this might be grisly. It is aware of many innocent households who have been merely following the very best mainstream recommendation of the time will undergo a severe monetary blow as mortgage charges rise.

Yet since its foremost job is to attempt to cut back inflation and get it down from its present 8.7% stage to its goal of two%, it feels duty-bound to wield the bludgeon.

Content Source: information.sky.com