Jeremy Hunt has forged doubts over introducing huge tax cuts on the subsequent finances, saying he’s unlikely to have the fiscal “room” he had within the autumn.

Earlier this month, the chancellor hinted at additional reductions come 6 March, saying the federal government’s plan of “prioritising tax cuts” was working, and that it will “stick to it”.

Politics stay: Minister makes awkward admission about his transient

The feedback adopted his determination within the autumn assertion to scale back nationwide insurance coverage by two proportion factors, with the Office for Budget Responsibility (OBR) saying it will value the Treasury £9.76bn within the 2028 tax yr.

But chatting with ITV, he confirmed studies he had warned the cupboard he might not have the ability to go that far in what might be the final huge fiscal second earlier than a common election.

“We go through a process ahead of every budget and autumn statement where you don’t actually know the final numbers until a couple of weeks before, and we’re still in the middle of that process,” he stated.

“As things stand at the moment – things can change – it doesn’t look like I’ll have the kind of room that I had for those very big tax cuts in the autumn.

“And I did point out that to the cupboard, sure.”

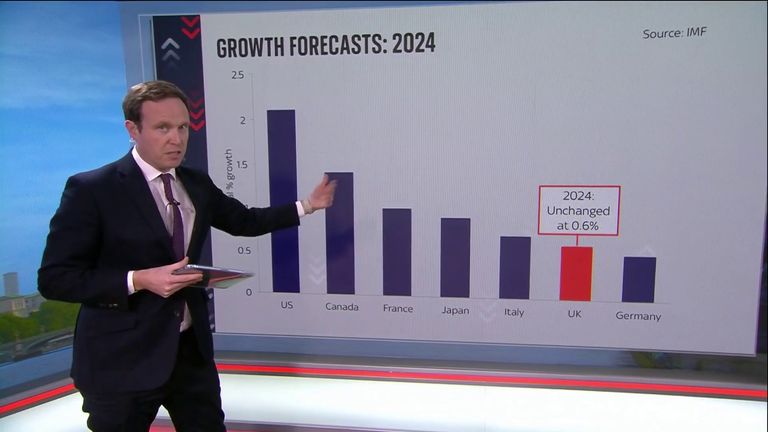

Mr Hunt’s remarks come a day after the International Monetary Fund (IMF) suggested the UK Treasury to not reduce taxes, and expressed scepticism in regards to the chancellor’s spending plans for the approaching years – elevating questions on his capability to satisfy his personal fiscal guidelines.

The financial physique stated: “Preserving high-quality public services, and undertaking critical public investments to boost growth and achieve the net zero targets, will imply higher spending needs over the medium term than are currently reflected in the government’s budget plans.”

It added: “Accommodating these needs… will already require generating additional high-quality fiscal savings, including on the tax side.”

Content Source: information.sky.com