Sir Keir Starmer paid £99,431 in tax final yr, in accordance with a abstract launched by the Labour Party.

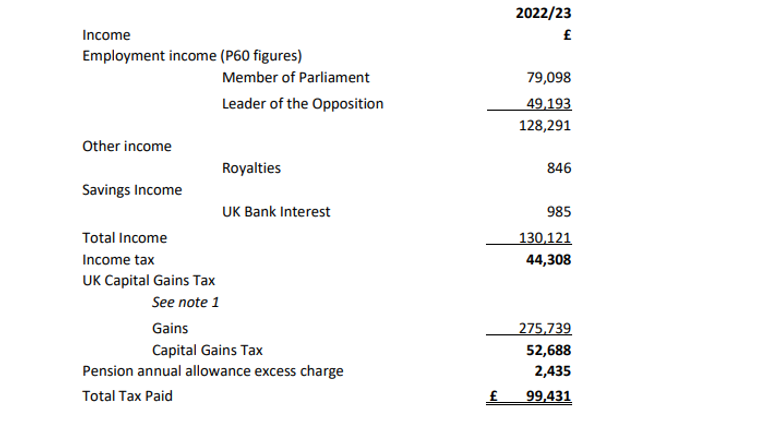

The launch, printed on Friday, confirmed that the Labour chief paid £44,308 in revenue tax in 2022/23.

He additionally paid £52,688 in capital positive aspects tax following the sale of a area in December 2022 partly owned by himself and partly owned by his father’s property.

The complete is greater than the £67,033 he paid to HMRC for the 2021/22 monetary yr

The paperwork additionally present the Labour chief earned £128,291 in his capability as an MP and the chief of the opposition.

Sir Keir printed the main points after Rishi Sunak printed his private tax return final week, displaying he paid greater than £500,000 in UK tax final yr, as his complete revenue rose to £2.2m.

Politics dwell: Backbench Tories ship message to Rishi Sunak after double by-election defeat

The abstract of the prime minister’s monetary affairs was made public as parliament was in recess.

The doc reveals he paid a tax invoice of £508,308 within the monetary yr 2022-23 – round £75,000 greater than what he paid within the earlier yr.

Mr Sunak made almost £1.8m by capital positive aspects – up from £1.6m in 2021/22 – in addition to £293,407 in different curiosity and dividends.

All of the funding revenue and capital positive aspects got here from a US-based funding fund listed as a blind belief, in accordance with the abstract.

He additionally earned £139,477 from his roles as an MP and prime minister.

Mr Sunak first stated he would publish his tax returns throughout his unsuccessful marketing campaign to be Tory chief in opposition to Liz Truss in the summertime of 2022.

The prime minister is regarded as one of many richest MPs in parliament and Labour has lengthy used his private wealth to argue that he’s “out of touch” with the issues of odd voters.

According to 2023’s Sunday Times Rich List, Mr Sunak and his spouse, Akshata Murty, the daughter of the billionaire co-founder of Indian IT big Infosys, have a mixed wealth estimated at about £529m.

Read extra:

Chancellor trying to lower public sector spending to decrease taxes, Sky News understands

Capital positive aspects tax: What is it, when do it’s a must to pay it and when are you exempt from it?

Pressure about their funds began piling on Mr Sunak whereas he was chancellor, after it emerged Ms Murty had non-dom standing – that means she didn’t should pay UK tax on her worldwide revenue.

Following a big backlash, Ms Murthy introduced she would pay UK tax on all her worldwide wealth to cease the difficulty from performing as a “distraction for her husband”.

However, the requires the prime minister to launch his tax particulars then grew louder following the controversy round Nadhim Zahawi, who was sacked as Tory Party chairman in January 2023 after he didn’t disclose hundreds of thousands of kilos in tax.

Content Source: information.sky.com