Check fraud has almost doubled amid a surge in organized mail crime that began throughout the COVID-19 pandemic, and specialists say it might spell the top for the once-popular cost technique.

The variety of examine scams banks reported to the Treasury Department’s Financial Crimes Enforcement Network soared from 350,000 in 2021 to 680,000 final 12 months, at the same time as examine use continued a 30-year slide. The company, generally known as FinCEN, estimates examine fraud value victims $24 billion in 2022.

Most incidents arose from thieves taking mail out of business bins, residential mailboxes and even U.S. Blue Bin receptacles the place people or small companies had positioned checks in stamped envelopes to pay their payments. Others got here from gangs of younger thieves robbing letter carriers, typically at knifepoint or gunpoint, to get the “arrow” keys that open postal containers all through a metropolitan space.

The U.S. Postal Inspection Service obtained about 300,000 complaints of mail theft in 2021, greater than double the 2020 tally. Last month, the U.S. Postal Service reported that 305 letter carriers have been robbed on the job within the first half of fiscal 2023, which ended March 31, placing direct thefts on monitor to be greater than double the 412 reported in all of fiscal 2022.

Bank investigators say these statistics present that checks have change into the riskiest means of paying payments within the digital age, despite the fact that many older adults nonetheless imagine in any other case.

“Checks are probably going to be phased out as the next generations grow up without using them,” mentioned Mark D. Solomon, a vice chairman of the International Association of Financial Crimes Investigators, a California-based nonprofit. “Financial institutions and retailers have become very suspicious of them because of how much fraud there is right now.”

Improved verification strategies and EMV chip card know-how, as an alternative of the magnetic stripe, have made it tougher for criminals to counterfeit debit and bank cards or get quite a lot of {dollars} from stolen playing cards, mentioned Mr. Solomon, who has spent years investigating monetary crimes for banks.

He mentioned that attracts criminals again to the benefit of “washing” checks with family chemical compounds, rewriting them to pay extra, counterfeiting checkbooks and utilizing or promoting the banking and routing numbers.

“Seniors think checks are a safe way to pay bills, but there are much safer ways of conducting transactions right now,” Mr. Solomon advised The Washington Times. “Checks are more vulnerable than other payment methods to being compromised, counterfeited or stolen.”

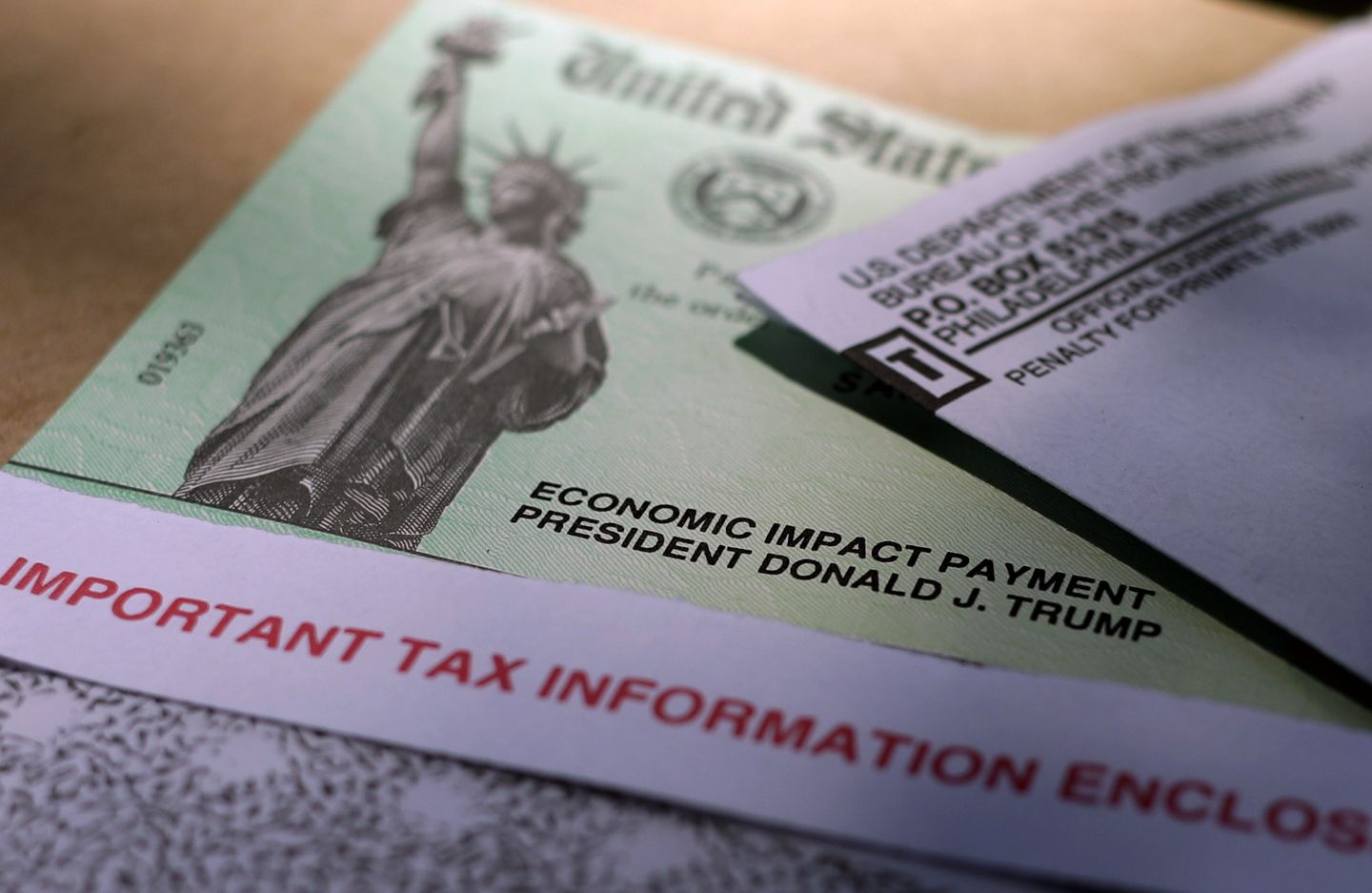

Reports of examine fraud grew early within the pandemic as legal gangs shaped to focus on authorities reduction checks. As the COVID stimulus ended, fraudsters began stealing extra invoice funds from people and small companies.

Criminal rings even have change into bolder about stealing the monetary identification of examine fraud victims, in response to the banking trade.

Many legal gang leaders now practice “mules” to speak persuasively to financial institution tellers as they create faux identities or companies, opening new strains of credit score primarily based on previous account data offered on the darkish internet. They then use the brand new debit playing cards and PINs to empty more cash from a sufferer.

Investigators say the crime rings recruit homeless and financially strapped people as members on social media. In one case in Southern California final 12 months, almost 60 alleged gang members have been arrested and charged with committing greater than $5 million in examine fraud towards 750 victims.

Check use has declined steadily since 1992 as extra adults have switched from money and checks to credit score and debit playing cards for many purchases. Today, they’re primarily used to pay payments.

Consumers wrote almost 3.4 billion checks final 12 months, down from greater than 19 billion checks in 1992, in response to information from the Federal Reserve. But the typical examine quantity rose from $695 to $2,652 over the identical interval — about $1,000 extra per examine than three a long time in the past, adjusted for inflation.

That makes scammers likelier to become profitable from faux checks than by stealing digital cost data or playing cards.

According to investigators, thieves spend small quantities on stolen bank cards to keep away from detection and normally get stopped after the financial institution calls cardholders to confirm the transactions.

By comparability, fraudsters can rewrite a $20 examine for $5,000 with no financial institution having any means of understanding what the examine ought to appear to be. With checks they can not wash, fraudsters use the banking and routing numbers to print counterfeits.

While cell phone deposit functions imply the thieves by no means should look a financial institution teller within the eye, others create faux IDs to make in-person deposits.

The problem of catching the scams exhibits the necessity for banks and retailers to maneuver away from accepting checks, mentioned John Berlau, director of finance coverage for the libertarian Competitive Enterprise Institute

“These new problems with checks show the importance of secure debit and credit cards for consumers and retailers,” Mr. Berlau mentioned in an electronic mail.

The American Bankers Association recommends utilizing pens with “indelible black ink” that’s tougher to clean, verifying deposits with examine recipients and reviewing financial institution statements on-line to guard transactions.

The affiliation additionally urges victims to report suspected fraud to the U.S. Postal Service and their banks.

“Working together as an industry, alongside law enforcement, the Postal Service and regulators, offers us the best chance at success,” Sarah Grano, a spokesperson for the American Bankers Association, advised The Times.

The most secure means of constructing a cost by examine is to drop it off in particular person at an area publish workplace or simply earlier than closing hours, and by no means go away it in a postal field in a single day, in response to USPS.

Postal inspectors say they’re seeing extra group and coordination of examine fraud than ever earlier than as legal rings share information via encrypted messaging and restricted content material on the darkish internet.

Last month, the postal service introduced a number of new safety measures to guard checks within the mail. The measures embrace putting in 12,000 high-security blue assortment containers in high-risk areas nationwide and changing 49,000 arrow locks on postal containers with digital locks.

“Generally, crime has increased since the start of the pandemic, our carriers are in neighborhoods delivering to 160 million delivery points daily, six days a week, and sometimes are in the wrong place at the wrong time,” U.S. Postal Inspector Michael Martel, nationwide spokesman for the Postal Inspection Service, mentioned Tuesday.

Content Source: www.washingtontimes.com